Yes, my favorite topic. Money money money money money! 💸

Ok, maybe not my favorite topic but a topic that comes up quite often if you are working in customer facing roles, such as sales. But enough with the damn sales, I need a break from all this raah raah and focus on a team that no company can do without and that’s customer success.

It’s almost comical how everyone has a different opinion on whether or not customer success teams should be paid bonuses. Some say they should and some say they shouldn’t because well all bonuses are for sales teams only right?!!!

So whether or not you’re in the camp that thinks success reps should be compensated with bonuses or not, almost everyone agrees that it’s a PITA to figure out what the compensation for the success team should be tied to.

Is it NRR? is it retention? is it expansion?

Thing is there is no simple answer. Primarily because there is no one way in which success is measured inside of a customer success team. Sales is easier in that regard, because you can attribute new MRR to every deal won and you can build quotas around that, CS on the other hand is quite nuanced.

Some companies measure bonuses and success of a CS team based on the net revenue retention, some focus primarily on retention and a lot of others on renewals and then you have companies that do a mixture of all these different metrics.

Regardless of how you decide to set comp up, you first need to answer a very important question.

What is the function of the customer success team?

Is your team focused primarily on retention? If so, comp should be tied to that. If the team is focusing on renewals or expansion? Well then it should be tied to the metrics that closely resemble what your team is focusing on.

Your targets and bonuses should always be tied to the work and result of the team in question.

Regardless, I strongly recommend offering bonuses to the success team. The introduction of a Base + Bonus plan is an excellent way to incentivize Customer Success Managers and encourage better performance. This bonus model generally should focus on both quantitative objectives (retention, upsells or cross-sell measures) as well as qualitative ones (contributing to the team mentality).

The important thing to note here is that you should not be putting a quota on the success team. When you put a quota on CS it dissolves the trust between the customers and their trusted advisor because now that person is only thinking about how much more money they can squeeze out of the customer and not focusing on how to provide value.

So important thing to note here is that quota and retention targets are two widely different things.

The thing about bonuses and measuring performance in the success team is that its surprisingly hard. I don’t think I have seen a single company that has perfected it so far because it’s simply hard to nail down. Every company has their own way of measuring performance and comp and go from super difficult to outright tricky.

I was having the same conversation with my CS team yesterday and not one of us could come to an agreement on what would be the best way to measure performance of the success reps that accurately represents the work they are doing. NRR is not good enough, because not all contraction and retention is because of the work thesuccess rep is doing, there will always be organic growth and contraction. What if you have one or two accounts in your book of business that have huge growth potential, so you’re a better CSM? Since the NRR due to all that growth will look much better than what the other reps have.

What if you have customers that tend to fluctuate a lot with their revenue, what happens then? Because the volatility in revenue will cause the NRR to go below 100% for the CSM, does that mean the rep is performing badly? of course not.

So what’s the answer? Since this isn’t one of the millennium prize problems, I think we can just chose one option that works best for the company and run with it.

Most important thing is to make sure you don’t go into analysis paralysis. You don’t need to analyze the living crap out of this, just look at the options, pick one and run with it. You can always tweak things over time.

So let’s breakdown a couple of options that I have seen work in multiple different companies and you can then pick and choose for yourself, which one works the best for you.

The NRR route

Net Revenue Retention (NRR) Rate is the percentage of recurring revenue retained from existing customers in a defined time period, including expansion revenue, downgrades, and cancelations. This churn metric gives a comprehensive view of positive as well as negative changes with respect to customer retention.

This perhaps is the most comprehensive way in which you can measure a performance of your team. Especially if you cannot come with the right answer to whether or not your CS team should focus on expansion, retention or both.

In a typical SaaS, a Net Revenue Retention rate of greater than 100% is a growth indicator. You always want to make sure that you are tracking this on a monthly basis and ensure that it stays above 100%, which shows that churns and downgrades of your book of business are being offset with expansion revenue.

With this metric, the CSM is essentially justifying their own existence, since they are adding more revenue to the company’s bottom line.

The key is to make sure that your CS team is retaining the customers that are in their portfolio. A high Net Retention Rate is an indication that the product you are offering represents a strong value proposition for your customers and whatever you are doing in the success team is clearly working.

NRR is also an indication of how well the CS team does with renewals, not only that but also how it generates additional revenue from the customer base following the initial sale, dubbed the “land and expand” strategy.

The formula to calculate NRR is:

Monthly Recurring Revenue (MRR) at the start of the month + Upsells - Churn - Contractions ÷ MRR at the start of the monthThe general rule of thumb and expectation for everyone in the CS team is to make sure that their Portfolio’s NRR is net positive, e.g. above 100% month over month.

Now that we got that cleared out, a lot of companies go with this option, well because it just works. How is the comp structured against the NRR? Well, again a topic where opinions vary, here is how I would and am currently do it.

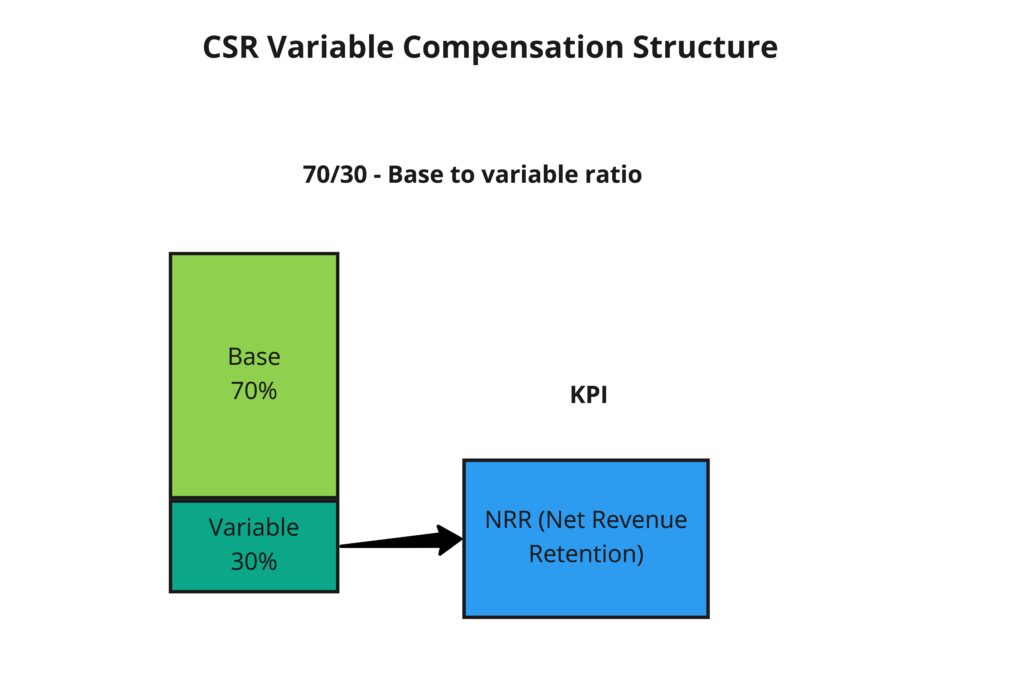

Incentives drive behavior. This is why a success team should operate with a 70/30 split when it comes to a compensation model (my opinion).

Meaning, 70% should be the base (fixed amount), and 30% should be the bonus variable, making up for your total OTE (On Target Earnings).

It’s important to really nail down the base and bonus split. If the variable comp is greater than 30%, it starts looking like a sales compensation plan.

However, if the variable is lower than 20%, the variable portion isn’t large enough to drive the added motivation and starts looking like a simple bonus plan.

This is why going ahead with the 30% option as it’s the perfect sweet spot. Variable pay is an effective way for any team to focus their energy on expansion opportunities.

This is why it’s imperative to keep the bonus plan simple and easy to understand as explained below.

Your comp (or bonus) structure is all dependent on your main KPI. Net revenue retention (NRR), why?

It is one of the most common KPIs Customer Success teams use measure their performance against, and for good reason as it helps CS teams understand if their revenue managed is expanding at a faster rate than any churn experienced.

NRR takes into account the total revenue under management at the start of a target period (monthly in most cases) and then looks at the same set of customers and how much revenue they account for at the end of the period.

I created this graphic a while ago when setting comp for my team, I think it gives a good visual of how things should and do look like in a typical CS team.

| NRR (avg across month) | % of payout | Example $100K MRR portfolio |

| 105% upwards | $500 for every 1% above 105% | $2,500 |

| 105% | 100% | $2,000 |

| 104% | 80% | $1,600 |

| 103% | 60% | $1,200 |

| 102% | 40% | $800 |

| 101% | 20% | $400 |

| 100% | 10% | $200 |

| 99% | 0% | $0 |

So the premise is that assuming the variable compensation bonus for every CSR is $2000 per month if they hit 105% NRR. $500 for every 1% achieved above 105% as an accelerator so the team does not stop when they hit 105% NRR. Bonuses should never be capped.This makes the variable compensation to be $24,000 per year if you consistently hit 105% NRR month over month. It will be much more if you over achieve your targets.

Net Revenue Retention (NRR) is extremely powerful. It shows us exactly how much we are growing our book of business and the impact that we are making as a success team.

The retention route

Now this can be done in one of two ways. Focusing primarily on retention is key here, you can either measure the performance and comp against revenue retention rate/revenue churn rate or account retention rate.

They both are similar in the sense that one is focusing on the revenue value and the other at the number of accounts that are churning out. Whichever option you decide to go ahead with, in my opinion the revenue retention rate is slightly better.

Why? Well, because if you have disproportionate amount of accounts in a CSMs book of business, every time a customer churns, say a low MRR org, it will have the same negative affect as a high MRR org churning, which really isn’t fair to the CSM managing those accounts.

On the flip side, if your accounts are contracting to a very low MRR state, the account retention rate won’t even take that into consideration since contraction does not = churn. And until the churn happens, the account and the metric remain unaffected.

So yea, if you have to pick one or the other go with the option of revenue retention rate.

And now the goal here is to ensure that CSMs are retaining as much revenue as they possibly can month over month. Revenue retention rate cannot go above 100%, so depending on the type or accounts a CSM has, you will want to make sure that the targets vary.

If the orgs are enterprise, keeping the target revenue retention rate higher makes a lot more sense as oppose to when you have smaller customers in your book of business.

With that said, let’s take a look at how a comp structure could be setup for the retention aspect.

| Revenue retention rate | Bonus payout |

| 100% | $2,000 |

| 99.5% | $1,500 |

| 99% | $1,000 |

| 98.5% | $750 |

| 98% | $500 |

| 97.5% | $250 |

| 97% | $200 |

| 96.5% | $0 |

So the format is similar to the one for the NRR, but the metric is wildly different and the compensation tied accordingly. This again is critical to ensure that you know what the objectives and goals of the CS team are.

Once you have a good idea of what you want the team to accomplish, run with the strategy that you think works well for your team and tweak is as you go along. There is no such thing as perfection when it comes to setting up comp, almost always you will miss your mark in the beginning.

But take an approach, work on it, get feedback from the teams, adapt and get it right so it fits your company and everyone is satisfied and happy with the comp plan.

Leave a Reply